News

Harvard Quietly Resolves Anti-Palestinian Discrimination Complaint With Ed. Department

News

Following Dining Hall Crowds, Harvard College Won’t Say Whether It Tracked Wintersession Move-Ins

News

Harvard Outsources Program to Identify Descendants of Those Enslaved by University Affiliates, Lays Off Internal Staff

News

Harvard Medical School Cancels Class Session With Gazan Patients, Calling It One-Sided

News

Garber Privately Tells Faculty That Harvard Must Rethink Messaging After GOP Victory

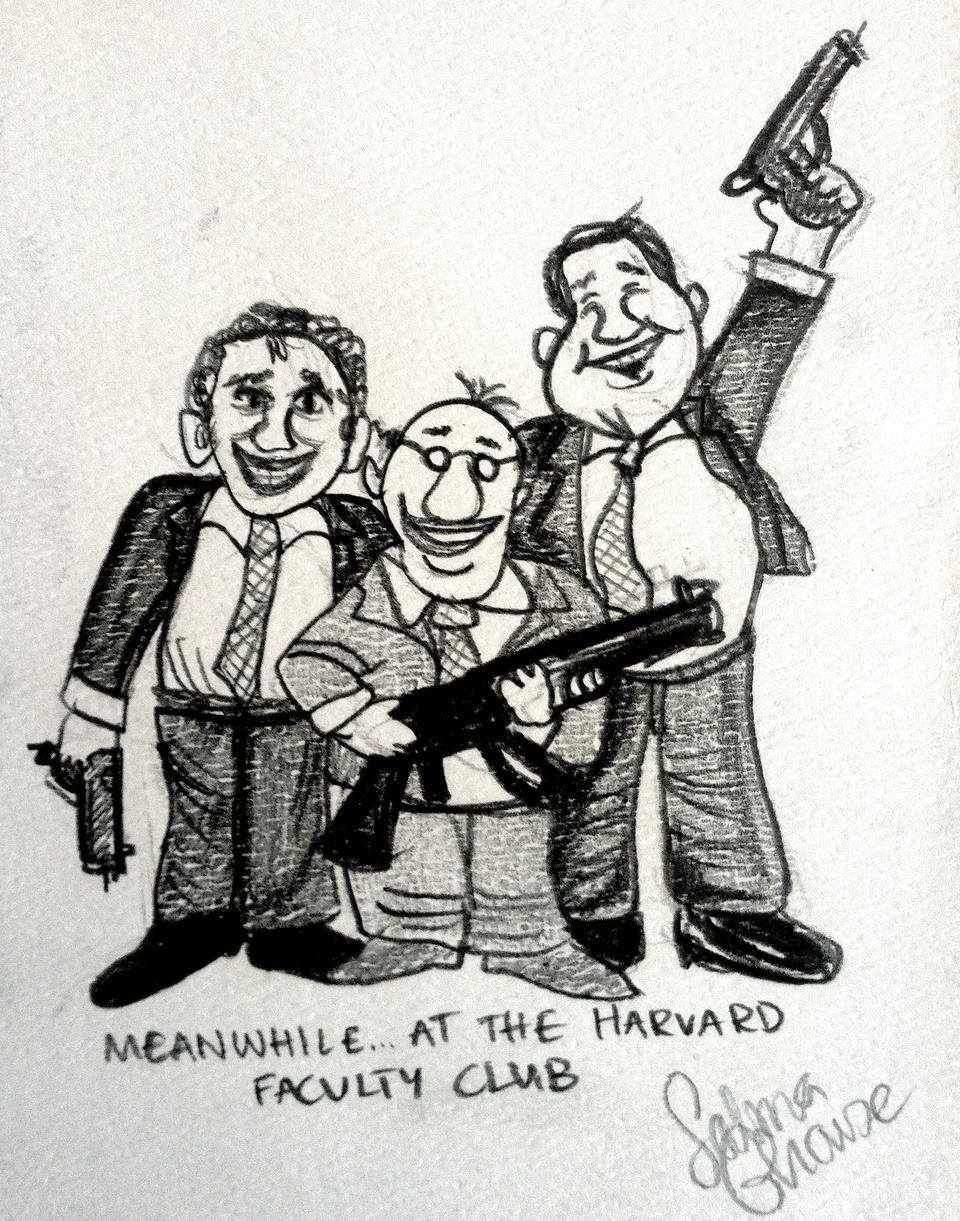

Irresponsible Divestment

The Responsible Investment Coalition has little to offer in investment insight or responsibility

Last week, a student group called Responsible Investment at Harvard criticized the Harvard Management Company for investing in an index fund that partially invests in gun manufacturer Smith & Wesson. The organization has chosen its name rather unwisely, because their criticism shows an ignorance of how investments work and a lack of responsibility.

First, the group was factually incorrect to call for Harvard to “sever financial ties” with gun manufacturers because Harvard has no financial ties to gun manufacturers. The morally dubious fund in question is iShares Russell 2000 Index Fund, an index fund that tracks the performance of 2,000 small-cap American companies indiscriminately. According to the prospectus of the exchange-trade fund, HMC is not a stakeholder of Smith & Wesson until it chooses to redeem its share in the ETF, a process that HMC is not qualified to do. The most that the group can claim is that Harvard’s endowment “gains exposure to Smith & Wesson’s price movement.” Also, even if Harvard owns stock in a company, it does not mean that Harvard’s money is supporting the company’s operations. Since Smith & Wesson is unlikely to raise capital in the future, both the ownership of the stock and price of the stock are irrelevant to the company’s daily operation. Claiming that Harvard’s money will “support the manufacture and production of assault weapons” is vast hyperbole and shows the group’s lack of understanding of the investment process.

The group’s call also lacks a sense of responsibility toward the University. Assuming that exposing Harvard’s endowment to gun manufacturer stock price movement is “symbolic of support for the industry,” one must wonder the extent of Harvard’s mortal sin. Since Harvard has about $2.8 million invested in the ETF fund and the fund allocates 0.5 percent of its investment in Smith & Wesson, Harvard’s exposure to Smith & Wesson is only $14,000. Divesting from the iShares Russell 2000 ETF, however, will be costly, because small-cap stocks generally perform better than the broader market.

Admittedly, there are socially responsible alternatives to the iShares Russell 2000 ETF, but all such alternatives consistently report dismal returns. All 14 small-cap funds in the SocialFund database performed worse than iShares Russell 2000 ETF since their inception, and five of the 14 are among the bottom 15 percent of all small-cap funds. Even if these funds do as well as iShares Russell 2000 in the future, their expense ratios are at least one percent higher than that of iShares Russell 2000. HMC will pay $30,000 more every year to manage the same small-cap exposure, equivalent to a one percent salary increase for 60 Harvard Union of Clerical and Technical Workers staff earning average salary.

Gun manufacturers are just one kind of investment targeted by Responsible Investment at Harvard, yet I am already concerned with their methodology for choosing divestment targets. Among the many externalities and injustices stemming from capitalism, the group has focused on a politically controversial issue with a convoluted connection to a small part of Harvard’s endowment. Perhaps the group’s goal is not to maximize Harvard’s endowment, but to promote a particular political stance in a controversial national debate (disclosure: I have no position on gun control). Even if we strongly agree with the politics, we should be skeptical about the practical gains of expressing these beliefs with respect to Harvard’s endowment. We must recognize that, contrary to what was suggested on the Undergraduate Council referenda last semester, it is unlikely that divestment will “avert environmental crisis” or invest “for positive social impact.” It would merely allow us to feel good about ourselves.

Although I have no objection to taking pride in the University’s investment practices, I believe the divestment movement needs to make a much stronger case for its recommendations. First, the movement must establish how Harvard’s investment in an industry can cause harm to society, not just why the industry itself is harmful. Second, the group needs to decide whether the social benefit from divestment is justified by its impact on Harvard’s ability to conduct academics and support staff, perhaps with help from the Vice President of Sustainable Investing. Before the divestment movement investigates such costs and benefits in a rigorous way, it is no more than a feel-good campaign relying on popular sentiments.

Jonathan Z. Zhou ’14 is an applied mathematics concentrator in Eliot House. His column appears on alternate Wednesdays.

Correction: March 26

An earlier version of this article incorrectly stated Harvard’s indirect investment in Smith & Wesson as $1,400. In fact, the figure is $14,000.

Want to keep up with breaking news? Subscribe to our email newsletter.